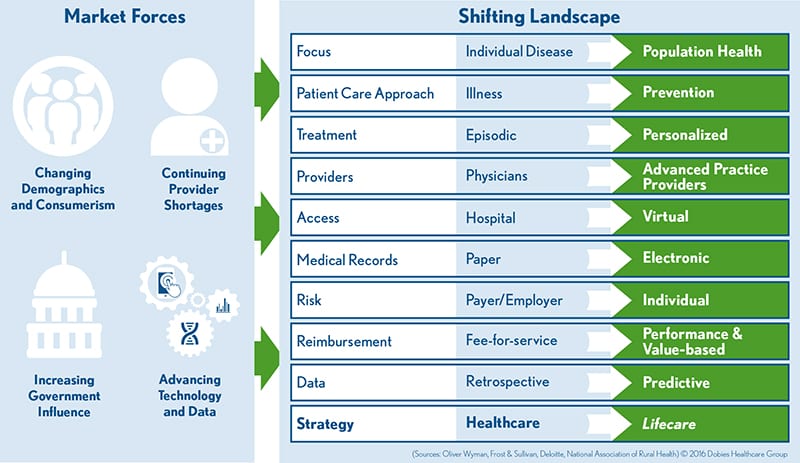

For organizations that operate within the U.S. healthcare system, change has become inevitable. Several major market forces are converging to change the size, shape, and scope of healthcare financing and delivery. Born from the premise that population health management must adapt to emphasize prevention as well as treatment, healthcare is now actively transforming into lifecare. Engaging people in their desire to remain healthy—beyond just receiving treatment when they are not—is the newest requirement for sustainability in the industry.

Imagine what a health system or health plan model built from the ground up would look like today. Instead of reflecting the long-standing industry focus on supply and demand for service, coverage and revenue churning, the new business model would likely be an evolutionary adaptation—an enterprise capable of meeting increased consumer demand for services that engage people in health throughout their life spans using innovative and effective channels.

In a white paper we recently co-authored with HealthScape Advisors, we call this the lifecare model – a new approach to meeting the full continuum of consumer needs related to staying healthy over time and ultimately creating healthier populations. By its very nature, the lifecare model cannot succeed in a vacuum; it is achievable only through collaboration. To seamlessly connect dots along the continuum of care, as well as the life span of the consumer, lifecare integration requires new partnerships between health systems, health plans and a host of other organizations at the local, community level.

The Lifecare Model: Creating an Ecosystem to Foster Healthy Lives

In this innovative model, consumers and suppliers (including payers) of comprehensive health services connect on a platform. An article published in the Harvard Business Review titled, Pipelines, Platforms and the New Rules of Strategy, notes that companies such as Apple, Uber and Airbnb have successfully unlocked the power of platforms. “Platform businesses bring together producers and consumers in high-value exchanges,” explain the authors. “Their chief assets are information and interactions, which together are also the source of the value they create and their competitive advantage.”

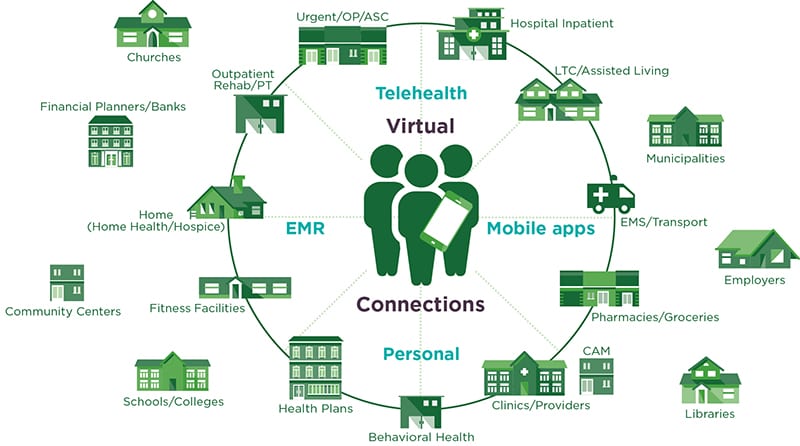

In the healthcare industry, the platform acts as a hub, facilitating interactions through which consumers can actively and continuously engage in their health. The ideal environment allows competitors and other players in the health space to become collaborators, working together on behalf of the consumer. Public and private partnerships provide greater access to community-based life products and services such as healthy foods, fitness programs and health education. Preventive health and wellness programs become more accessible and personalized, leading to increased engagement and utilization.

[bctt tweet=”New #lifecare model creates sustainability for enterprises operating in today’s health industry.”]

Lifecare is about inspiring and supporting decisions that encourage healthy lives, which means the focus on health must (1) put the consumer at the center, and (2) extend far beyond traditional delivery and financing systems. Schools, churches, libraries and grocery stores can all be viewed as community partners working to promote health, as can employers, community centers, ancillary providers and many others. More consumer engagement with these partners will lead to more interactions with all purveyors and payers along the continuum, making lifecare a highly sustainable, consumer-centric model with real potential to make a meaningful impact on individual and population health.

Disruption through Innovation

Equally important to the lifecare vision is the ability of enterprises to create disruption in the traditional sense, where innovative operating protocols and collaborative marketplace alignments take on new meaning within the enterprise. As pressure to reduce cost of coverage and care continues, many enterprises are responding with new product and service innovations, usually in the form of technology solutions. Healthcare disruptors come poised to compete – but they also carry real, actionable potential to enter the market as good collaborators for the lifecare platform model.

Some disruptors are focusing on integration with community agencies to facilitate better access to services that help people stay healthy. Others are bringing new distribution channels into markets outside the traditional framework, including targeted product offerings toward technology-oriented consumers. From consumer-facing solutions such as telehealth, digital health coaching, virtual health memberships and integrated lifestyle modification networks – to provider-focused solutions like prescription monitoring for physicians, predictive analytics for home health clinicians and more – innovation that identifies and tracks how consumers will expect service and care in the future will come to enterprises that focus on staying ahead of others in the race.

Growing venture capital interests in the healthcare industry are further fueling disruptive innovation in mobile and virtual healthcare, financial services, and a range of “big data” and health analytics initiatives. This, coupled with high levels of consolidation and accelerated diversification strategies among several large insurers and health systems, signals that we should anticipate the emergence of new, innovative and consumer-oriented solutions. Potentially, venture funds will find healthy investments in lifecare transitions and underwrite innovative disruption to strengthen platform strategies now underway. More importantly, they may invest in creating entirely new ones in the future.

In other words, the ability of present-day healthcare enterprises to remain innovative and build alliances with consumers via marketplace disruption throughout the next decade will drive the new, consumer-centric approach. And, as the healthcare market continues to evolve toward the consumer, there too will be unique and creative responses to meet the expectations of this new era.

[bctt tweet=”#HealthcareConsumerism is driving industry collaboration toward health & #lifecare.” username=”DobiesGroup”]

Building a Lifecare Platform Strategy

Developing a lifecare platform strategy is complex but necessary, and the time to begin your planning is now. With the health industry’s rapid transformation into consumerism, population health, value-based reimbursement and even empowering consumers to monitor their health in their daily lives, healthcare entities that are slow to embrace a collaborative, consumer-centric lifecare model will get left behind. Particularly as mhealth, virtual health, wearables and other types of consumer health technology become more and more sophisticated and commonplace, we need look no further than the state of today’s taxi industry to see the effects of responding too slowly to disruption and the rise of consumerism.

Successfully creating your new business model design requires a firm commitment to strategic business planning, organizational readiness assessments, collaborative partnerships, cultural alignment, consumer engagement and brand authenticity. There is no universal approach – the scope and application can and will vary from one enterprise to the next, but all will have at least one common denominator: collaborative partnerships – even among organizations that once viewed themselves as competitors – with a shared vision of keeping people healthy throughout their lives. Acute, episodic, bricks-and-mortar-based care will always be needed, but it is no longer enough. The wave of the future involves reducing illness and injury by making healthy living more pervasive in everyday life.

How will your organization adapt? For in-depth insight that may help you answer that question, download “The Emerging Lifecare Model: How Consumerism is Driving Industry Collaboration Toward Health and Lifecare as a New Strategic Platform” [white paper].

About the Authors

Julie Amor, Chief Strategy Officer for Dobies Health Marketing, brings more than 20 years of experience elevating healthcare brands to our firm and our clients. Julie co-authored this article with several industry thought leaders: Carol Dobies, Chief Executive Officer and Founder of Dobies Health Marketing, and a 25-year brand and marketing advisor; Arjun Aggarwal, a co-founder and Managing Partner at HealthScape Advisors who has more than 25 years of experience helping health plans and health systems understand the demands of a constantly evolving healthcare marketplace and plan for the future; and David Gentile, Senior Advisor at HealthScape Advisors and the former President and Chief Executive Officer for Blue Cross Blue Shield of Kansas City.

Julie Amor, Chief Strategy Officer for Dobies Health Marketing, brings more than 20 years of experience elevating healthcare brands to our firm and our clients. Julie co-authored this article with several industry thought leaders: Carol Dobies, Chief Executive Officer and Founder of Dobies Health Marketing, and a 25-year brand and marketing advisor; Arjun Aggarwal, a co-founder and Managing Partner at HealthScape Advisors who has more than 25 years of experience helping health plans and health systems understand the demands of a constantly evolving healthcare marketplace and plan for the future; and David Gentile, Senior Advisor at HealthScape Advisors and the former President and Chief Executive Officer for Blue Cross Blue Shield of Kansas City.

Share your thoughts about this article by tweeting @DobiesGroup or commenting on our Facebook page.