Optimize your share of voice to grow market share

As a hospital marketing leader, you know how noisy the competitive landscape can be. As the industry shifts toward a consumer-centric healthcare marketplace, it seems every hospital and health system is vying for the same patients—and they all have advertising dollars devoted to buying the largest megaphone.

In today’s hyper-connected world, consumers are bombarded by advertising messages at every turn; one estimate suggests consumers are subject to 3,000 to 5,000 messages each day. Healthcare is no exception, so what is your strategy for determining reach, frequency, and key messages to best position your healthcare organization? After all, if you’re in the orchestra, it’s better to play the trumpet than the piccolo.

Amplify Your Voice for Bigger Gains

Clever ads alone rarely produce sustainable results, so the relationship between your ad buying strategy and your market share growth should be treated with care. It is important to understand the correlation between share of voice (SOV) – defined as your organization’s percentage of the total media buying in your industry for a specific time period – and share of market (SOM), which is your percent of the total revenue for that same time period. You probably already know your market share, but your SOV can be more complex. Knowing your SOV relative to your competitors, however, can be critical to your strategic advertising efforts for top-line growth.

The Nielsen Company published research that sheds light on this relationship between SOV and SOM. They found that with everything else equal, you are more likely to gain market share if your SOV is larger than your SOM. This “excess” share of voice is shown to have a very direct effect—an increase of 0.5 percent additional market share when your SOV is 10 points higher than your SOM.

Of course, rarely is the math that simple. The same research found that a lot of factors play into this, including the size of your brand, whether you are the brand leader in your industry or a brand “challenger,” and of course, the level of sophistication in your creative campaign. If you are the brand leader, for example, a 10-point differential can net you as much as a 1.4 percent market share boost.

Even with multiple variables, savvy marketers can still make this research work for them. Dave Beckert, a media planner, gives this advice:

“Smart marketers investment spend (SOV slightly exceeds SOM) to some degree to deter attack. To show major gains in SOM, you must create or exploit disequilibrium … using advertising spending as an offensive weapon, based upon an analysis of the competitive situation.”

Use the Right Tool for the Job

As the former VP of Marketing for a major academic medical center, I cannot overemphasize how necessary it is to have competitive market data driving strategic recommendations for media planning and creative concept development. In addition to providing the foundation of those recommendations, I needed the competitive data to secure support for the marketing and advertising budgets I proposed. The only problem was that collecting a comprehensive market analysis of competitors was incredibly arduous and time-consuming.

Now, that’s no longer true. The need for robust competitive market data is still great, but the work that goes into creating those market profiles is not, thanks to an innovative product called soviews+.

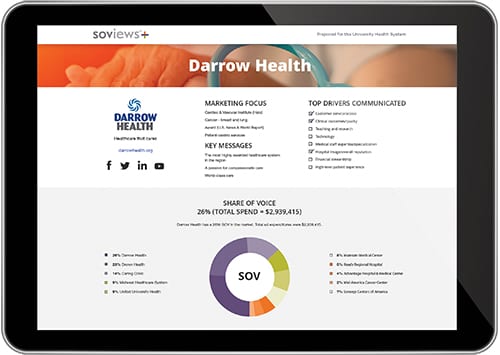

Custom designed for hospitals and health systems,soviews+ packages comprehensive competitive market profiles into a single interactive tool, empowering you to view and compare what competitors are saying in your local market with only a few clicks. soviews+ lets you see and hear your competitors’ creative assets for TV, print, digital and mobile advertising. Additionally, soviews+ provides a market analysis of each hospital’s key positioning messages, SOV and ad spend. These analyses provide much-needed clarity and the competitive advantage to aid in capturing a larger SOV for your organization.

I recommend soviews+ because it was designed for healthcare marketers by healthcare marketers, and it offers meaningful insight to guide healthcare advertising strategies. You can finally answer such questions as, Should we be buying magazine display ads? and Will that many TV spots even make a difference? soviews+ gives you the power to see your local market differently – and when you can stand up and see who is playing in the orchestra, you can finally decide if you need to pick up a louder horn. If you are a hospital marketer, that should be music to your ears.

Julie Amor is the President and Chief Strategy Officer for Dobies Health Marketing and has more than 20 years of experience elevating healthcare brands. Share your thoughts with her by tweeting @DobiesGroup or by commenting on our Facebook page.